Life does not always revolve around money but money does matter especially when we talk about gaining financial success in the near future. Young as you are, it is important that you get to understand the value of money and how learning to handle your own budget helps a lot. Thus, a budget plan comes in handy for this goal.

What is a “budget plan”?

Sometimes, when you receive a huge amount of money. You usually find yourself buying products and services carelessly and ending up with nothing. A budget plan, therefore, is significant to ensure that you spend accordingly and wisely. This pertains to how you wish to track your spending through detailing your budget and expenses in order to foresee or achieve a financial goal. Most people use this to ensure that they do not overspend within a month.

What is a budget plan without understanding the essentials of it? Here are some financial terms each should know:

- Budget – a budget is an allocated amount that one uses for a set period of time.

- Income – the money that is earned or received on a regular basis may it be through work or investments.

- Allowance – a regular amount of money received by or given to an individual.

- Expenses – this refers to the money spent on something

- Savings – this pertains to the money or income not spent or money which is placed on hold and not consumed until a specific need or time comes.

Steps in Creating a Simple Budget Plan

Having a budget template is one of the most convenient things you can do to achieve financial control. A spreadsheet may be utilized to draft your monthly budget plan template. Question is, how does a budget plan work?

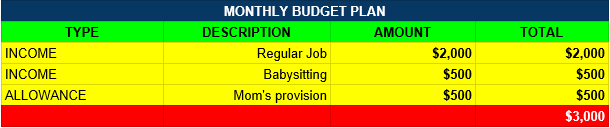

Step 1: Evaluate your Monthly income/allowance

The first thing you have to do is to assess how much money you have on a monthly basis. Think of the principle of not spending more than what you are earning. For others with variable income, you can at least have an estimation of a specific amount for you to budget.

Here’s an example of assessing the amount of money you are receiving on a monthly basis:

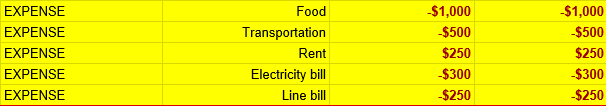

Step 2: Evaluate your monthly expenses/obligations

When creating a budget plan, it is always advised that you evaluate first your monthly obligations or expenses. Define a budget that you normally spend for rent, transportation, bills, and many others. This step does not require detailed information about your expense, just an estimation will do. For instance, for a variable expense such as electricity consumption, you may place a budget of $250.

Example:

Notice that I placed the amounts in red and added a negative sign before the numbers as this would indicate that the specifics are expenses/obligations.

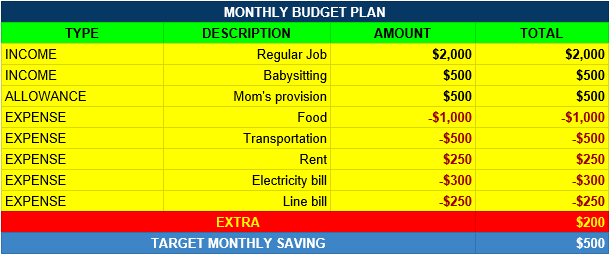

Step 3: Indicate a monthly goal

A monthly goal is optional. If you wish to find motivation in staying religious to your budget plan, then indicating a goal such as a target monthly saving would help. In addition, allowing yourself to allocate a specific budget for extra things or discretionary spending such as a night out with friends, spa treatment, groceries, pets, among others would also help draw a line for you to not overspend.

Step 4: Review your Draft Budget

After you have indicated your income, expenses and goals, review your budget plan and assess whether the expenses, including the extra budget, do not exceed the income that you are generating on a monthly basis. If it doesn’t, then you are set for the month and can carry on tracking your expenses so as to follow the budget plan you have created.

Step 5: Start tracking your expenses

Assess your spending by updating your budget tracker on a daily or weekly basis. This time, you need to add specifics to your trackers such as date, type, description and amount. This is when mobile budget tracking apps come in handy.

![]()

Email us at dare2dreamleaders@gmail.com to get a copy of our budget plan and tracker sample and template.